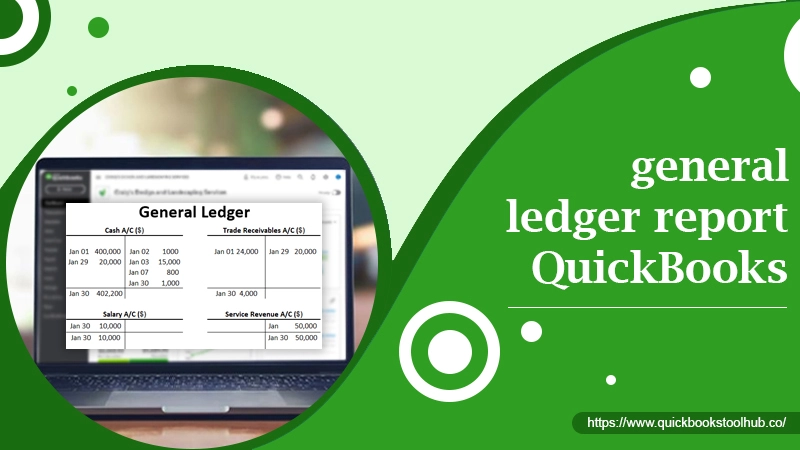

Find and Make a Detailed General Ledger Report QuickBooks

QuickBooks offers extensive features for small and medium-sized businesses to do their accounting tasks easily. It has various reporting options that make monitoring money easy. General ledger report QuickBooks allows you to track transactions from Cash, Equity, and Undeposited Funds and Accounts Receivable accounts. The information from the general ledger report can be used to make financial statements. Thus, stakeholders can find out how the business is performing.

You can view any transaction report in the general ledger, and it’s enough to check transactions that happened during a specific time. Keep reading to understand how to find general ledger reports in QuickBooks and the steps to make a journal entry.

What Is General Ledger Report QuickBooks

The general ledger report gives you a glance at all your company’s financial transactions and activities. The general ledger has a debit and credit account for every transaction. You can view financial activities across various accounts for a particular date range.

Essentially, general ledger detail report QuickBooks Desktop record having individual accounts along with the transactions pertaining to every one of those accounts. Through it, you can gain insight into the result of transactions regarding a specific account(s) on a particular date. The three crucial journals in QuickBooks include

- Accounts Receivable, i.e., the record of a firm’s sales and receipts.

- Accounts Payable, i.e., the record of an organization’s purchases and invoices that need to be paid.

- Payroll, i.e., the record of the salaries of employees.

Read about:-QuickBooks unrecoverable error

The Major General Ledger Account Categories

A general ledger account is divided into assets, equity, revenue, and liabilities. Here is their detailed explanation.

- Assets – These are the resources that are valuable for a firm to use to generate profit.

- Liabilities – They are obligations that an organization owes to another company, such as bank loans, payroll, etc.

- Equity – It is the difference between overall assets and liabilities. The three parts of an equity balance include common stock, additional paid-in capital, and retained earnings.

- Revenue – It gets generated when goods or services are sold.

- Expenses – A firm incurs expenses to produce a profit.

How QuickBooks General Ledger Works?

The general ledger functions by following a certain procedure, mainly double-entry accounting. In order to produce financial statements, the QuickBooks ledger report requires credit cards, debit cards, and dollar amounts. The general ledger will make financial statements only if the following criteria are met:

- The number of credit and debit accounts used shouldn’t be the same.

- The dollar amount of debits and credits should be equal.

- There should be at least a single credit and debit entry for every journal entry.

The Process to Find General Ledger Report QuickBooks

To get this report, you should first purchase a QuickBooks plan. After that, just follow the pointers below to find out the general ledger in QB.

- Sign into your QB account and head to ‘Reports.’

- Go to the ‘Accounting Reports’ option in the ‘Standard’ tab.

- Here, the general ledger report will be there.

- If you don’t want to follow this method, just use the search box to search for the general ledger. Then, tap the ‘Recommended‘ option.

The Steps to Make and View a General QuickBooks Journal Entry

It’s easy to create a QuickBooks GL detail report. Use these points to produce this journal entry.

- Go to the company menu in QuickBooks.

- Here, choose ‘Make general journal entries.’

- In its window, modify the ‘Date‘ field.

- Type any number of entries in the field that indicates it.

- Now, input the information of the general journal entry.

- If you utilize Accounts Payable or Receivable, the first account in your general journal transaction entries should indicate it.

- Users selecting the ‘Debit or credit columns‘ should input the requisite amount for the account.

- You can enter a memo that will be shown on reports such as this entry.

- Now, choose the employee, vendor, or customer related to the transaction.

- If you choose an ‘Expense‘ use the amount billed to the customer. Then allocate a class to that amount.

- Repeat all these steps till your transaction comes to zero balance.

- Next, tap ‘Save & Close.’

To view this QuickBooks ledger report, you can head to the ‘Reports’ option. After that, use these points.

- Highlight the option ‘Accountant and Taxes.’

- Then tap ‘General Ledger.’

- Choose ‘Customize Report.’

- Now, go to the ‘Display‘ tab.

- Tap ‘Advanced‘ and choose ‘In Ise.’

- Press ‘OK‘ two times.

QB General Ledger Vs. Transaction Data Entered by an Account

The QuickBooks GL detail report and the transaction details by an account tell you how your business is managing money. Here’s the difference between both.

Double-entry bookkeeping

QB employs double-entry bookkeeping and needs the setting of credit in a single account for every debit in the other account. Both the transaction details by account and the QuickBooks ledger report facilitates you to see all the double entries for a specific account.

General ledger reports

The general ledger report gives you the starting and ending balance of every transaction for the period under the account. The report helps you to scan your registers for unpredicted ending balances easily. It also helps you find if there are any unexpected credits in the expense accounts and debits for the revenue account.

Transaction details

The reports of transaction details by account work similarly to the general ledger reports. But it only shows transactions for a particular account. This data includes the kind of transaction the account used for it, the date, sub-totals, and totals.

Personalizing reports

In both QuickBooks GL detail report and transaction details by account, you can change the time displayed. In both, you can double-tap the transaction in one of the reports to see more information about it. It’s also possible to organize the report by amount ascending, descending, a report by date, and by document number.

The Advantages of General Ledger Report QuickBooks

The QB general ledger is a crucial record. It provides numerous benefits. It allows you to track different transactions under specific account heads easily.

- Financial statement creation – It’s unthinkable to make financial statements and balance sheets in the absence of a general ledger detail report QuickBooks Desktop. It, in turn, makes it effortless to evaluate the profitability of your business.

- Better knowledge of the business – A properly prepared general ledger enables business owners to gain a deep insight into their business. You can determine your position with regard to creditors, debtors, expenses, and profits, among others.

- Effortless audit – The information gleaned from the general ledger helps you confirm if different items are classified correctly. You can also identify incorrect statements before they create other problems.

- Prevents you from incurring unwanted expenses – If you don’t divide transactions under different heads in the general ledger, you can accumulate many unwarranted transactions. You cannot find out if you incurred greater expenses in case someone overcharges you.

Final Thoughts

The general ledger report QuickBooks is essential to analyze the financial health of any business. You can better understand the results of different transactions on a certain date. It is extremely simple to find and prepare a general entry in QuickBooks. If you need any more clarification about it, speak to a QB technical support team.

2 Comments

Why QuickBooks Unrecoverable Error · November 4, 2022 at 7:15 am

[…] Read about:-general ledger report quickbooks […]

What Is General Ledger QuickBooks and How to Print It? · November 8, 2022 at 1:25 pm

[…] that you are a lot more familiar with the General Ledger report in QB, you can learn to find it. Use these pointers to discover […]